How to perform GST E-submission F8 on Financio. Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final GST taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from 01092018 before 29122018.

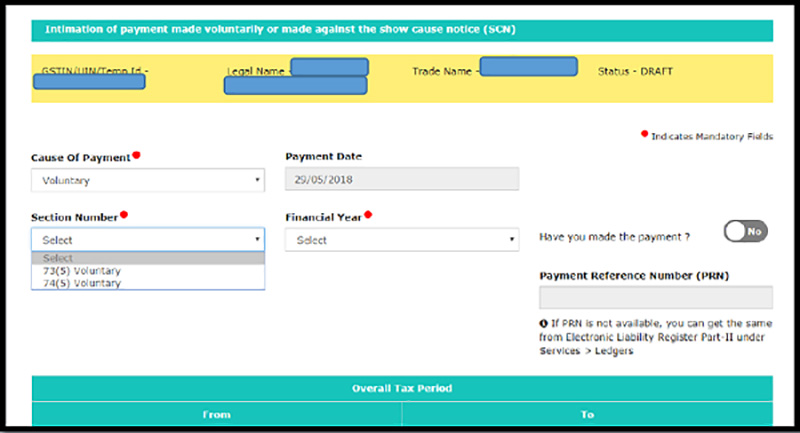

Easy Guide To Form Gst Drc 03 Voluntary Scn Payments

The standard GST Return due date of filing for GSTR 3b is the 20th of Next month.

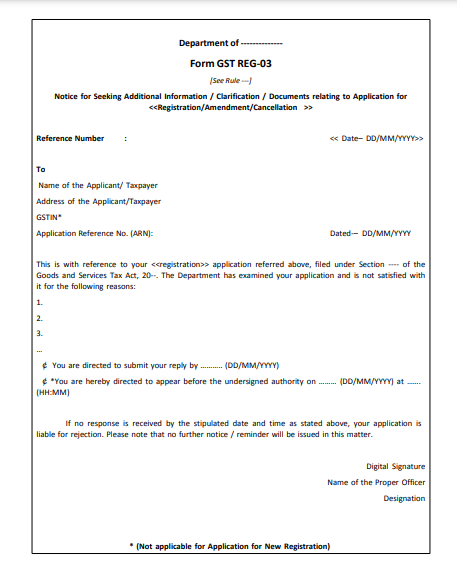

. Time Limit of Issuance of Form GST REG-03. The CRA will. Seeks to extend the last date for furnishing of annual returnreconciliation statement in FORM GSTR-9FORM GSTR-9C for FY 2017-18 till 31012020.

Select the year and the month for which you want to reset GSTR-3B. However these dates can be extended by the government. Click on Reset GSTR 3B.

The Canada Revenue Agency CRA can charge penalties and interest on any returns or amounts we have not received by the due date. According to the provisions of rule 9 2 of the Central Goods and Service Tax Rules 2017 the proper officer is required to issue a notice in Form GST REG-03 within a period of three working days from the date of submission of an application. Since you have already submitted your return the option to Reset GSTR 3B will be activated.

The amendment to the final GST-03. This is a reminder to businesses that the amendment to the final GST-03 return if any needs to be made by 31 August 2020. Login to the GST portal and to go to the Return Dashboard.

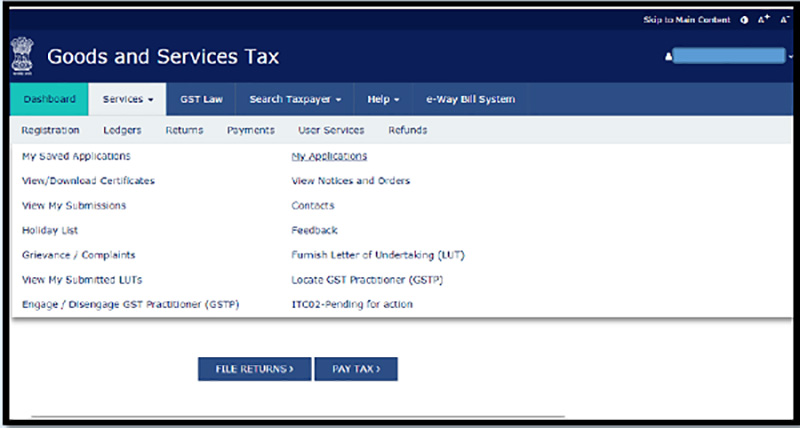

GST tax portal has the provision that allows you to do so. There is a section in the GST portal that talks about user services. Through a vide notification no.

Due dates for filing a GSTHST return. GST Guide on Tax Invoice Debit Note Credit Note and Retention Payment After 1 September 2018. The basic provisions of Rule 9 2 of Central Goods and Service Tax Rules 2017 states that for the proper officer it is necessary to issue a notice in Form GST REG-03 within three working days from the date of submission of the form by the applicant.

Extension of time limit for intimation of details in FORM GST CMP-03 Order-032017. GST the dream of Central Government will finally come true as GST Council has granted approval to CGST IGST SGST UTGST and Compensation law and these laws have been approved by the cabinet. 31072015 5 Cukai Output Output Tax a Jumlah Nilai Pembekalan Berkadar Standard Total Value of Standard Rated Supply.

March 20 2020 at 849 pm. Pls gst 3b last date 201718 and 164 reply drop. Last day for submission payment Monthly Period - 01082018 31082018 Latest by 31th August 2018 29122018 Bi-Monthly Basis - 01072018.

The personalized GSTHST return Form GST34-2 will show your due date at t he top of the form. At the industry Codes page the details will refer tot he details in GST-03 last part webixs system. Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period not.

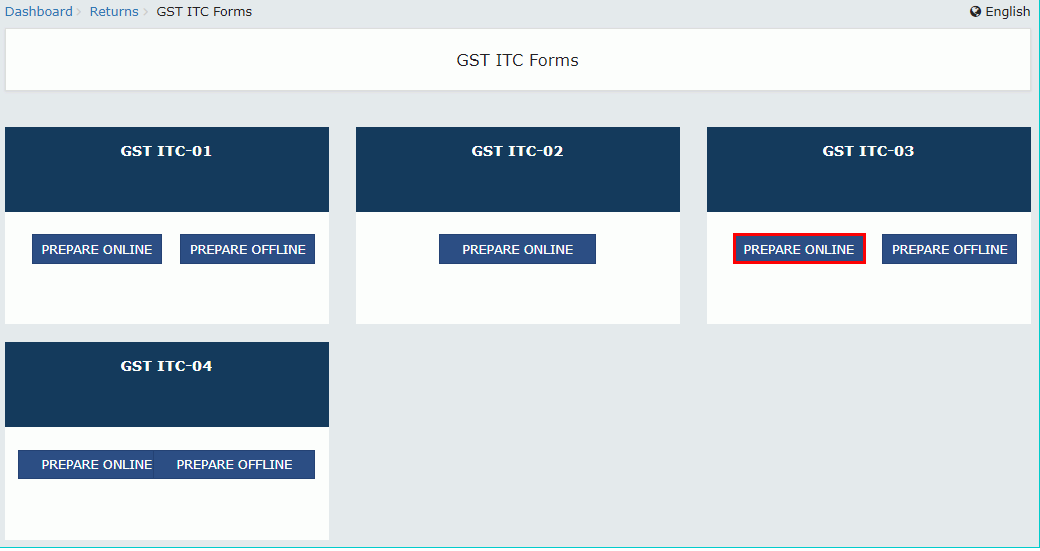

Select Section and enter details in various tiles. Answer 1 of 4. Click on Prepare Online.

Extension of time limit for submitting the declaration in FORM GST TRAN-1. The due date of your return is determined by your reporting period. Click on Yes and OK.

TAP system will redirect to the page as showed in figure below. Due dates of Gst Filing Extended Due to Corona vires issue 1. However a proviso has been inserted in Rule 9 2.

Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period. Login and Navigate to Form GST ITC-03 page. The intimation in FORM GST CMP-02 can be filed on or before 30-06-2020 and Form GST ITC-03 for ITC reversal should be furnished by 31-07-2020.

Last day for submission payment Monthly Period - 01082018 31082018 Latest by 31th August 2018 - -28122018 Bi-Monthly Basis 01072018. MUST choose the correct GST period before proceed to click on the File Now. Head over to GST filing Step 2.

On the main screen select File Now to start submit the GST-03. A compendium of all the changes in GST Due dates for various GST Returns - GSTR 1 GSTR 3B GSTR 9 GSTR 6 GSTR 7 GSTR 8 ITC 04 etc. Please take note that your Final Taxable Period is until 31 August 2018 ONLY and final submission.

All GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from 01092018 to 29122018. So once again GST will become a matter of discussion for all industries. GST Impact on last Service Tax Return ST-03.

03 Feb 2020. You may see our GST notifications page for any notifications mentioned here to check. Goods and Services Tax.

MOHAN ARYA 22 March 2017. Update Certifying Chartered Accountants or Cost Accountants Details. Use DRC 03 to make additional payments.

Section 184 a Section 184 b C. 622020- Central Tax dated 20th August 2020 a proviso is inserted to. Click View on the report for your final submission.

Note that Financio would automatically detect and show you the correct form respectively for the type of. Article compiles month-wise due date Last Date of filling GSTR3B for Financial Year 2017-18 2018-19 and 2019-20 as extended from time to time by various Notif. Click on the 3 dots at the right corner of the window and select Filing Submission.

Gst is pending from last August 2019 to Oct. The GSTR 3b due date for October 2020 to March 2020 is notified by notification no. According to the GST guides no GST adjustment is allowed to be made after 31 August 2020.

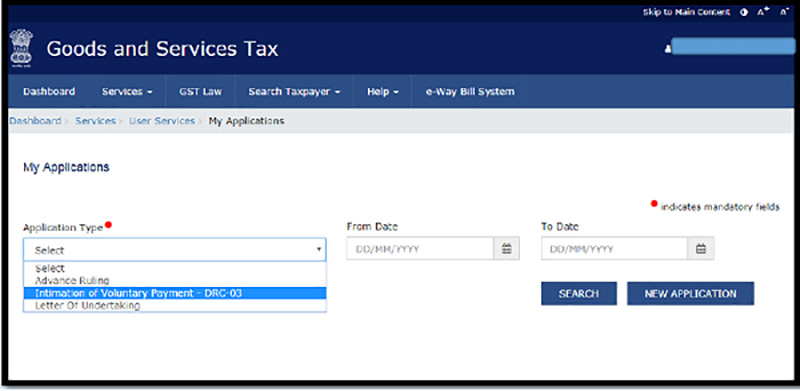

The last date for the submission of return and payment is the last day of the following month according to the taxable period as item 3 above. 31052015 Quarterly taxable period. There you need to choose DRC 03 and then opt for.

Last date for filing GSTR-3B in March April and May 2020 will be extended till the last week of 30th June 2020 2Those having aggregate annual turnover less. 20 April 2020 N. During the course of filing GST Return a taxpayer may discover additional tax liabilities that he or she may need to pay.

Monthly taxable period.

Appointment Of Ca Firms With Pspcl For Ind As Implementation Http Taxguru In Finance Appointment Of Ca Firms With Pspcl Corporate Law Finance Appointments

Gst Itc Credit Setoff Order Changed Wef 1st Feb 2019 Accounting Services Order State Tax

All About Gst Reg 03 Form With Issuance Reason Time Limit

Here Are The Simple Steps For Gstregistration Https Gst Registrationwala Com Gst Registration Bar Chart Chart Pie Chart

Easy Guide To Form Gst Drc 03 Voluntary Scn Payments

Notice In Form Gst Reg 03 For Seeking Clarification Relating To Gst Registration

Itc 03 Prerequisites And Steps To File Itc 03 On The Gst Portal

Revised Form Gst Drc 03 Procedure For Intimation Of Voluntary Payment Indiafilings

Gst Itr 03 Filing Gst Portal Procedure Indiafilings

How To Reply To Gst Reg 03 Form User Manuals

Epf Form 15g Download Sample Filled Form 15g For Pf Withdrawal Gst Guntur Tax Deducted At Source Taxact Employee Services

Easy Guide To Form Gst Drc 03 Voluntary Scn Payments

Easy Guide To Form Gst Drc 03 Voluntary Scn Payments

Gst Annual Return Return Annual Chartered Accountant